VAT Rate Changes

As part of the July Stimulus Package the Minister for Finance has announced a temporary reduction in the standard rate of VAT for a six month period. On 1 September 2020, the standard rate of VAT will change from 23% to 21%. The rate is due to revert to 23% with effect from 1 March 2021.

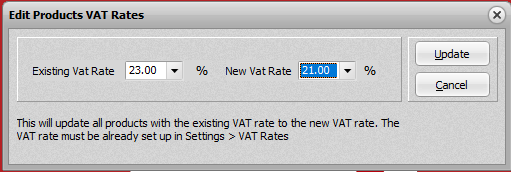

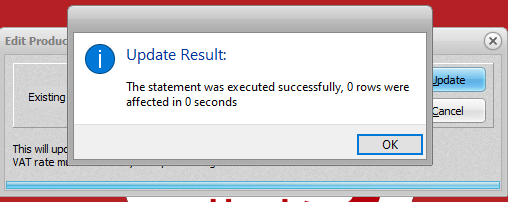

We have added a ‘Edit Product VAT Rates’ Utility to the latest versions of Big Red Book Accounts v8 and v9. This update can be downloaded from here if required.

For most transactions between VAT registered traders, it will be “cash neutral”; however, there are a number of administrative issues to take into account.

Invoices

- On or after 1 September 2020 VAT invoices issued by a VAT registered person (who is not on the cash receipts basis) to a VAT registered person, a public body or a business carrying on a VAT exempt activity should show VAT at the new 21% rate. This is so even if the goods or services were supplied before this date.

- A trader on the cash receipts basis who is required to issue a VAT invoice to another VAT registered person should show the VAT rate which applies on the date of the supply, not on the date of receipt of payment.

- Goods or services which are actually supplied to consumers prior to 1 September 2020 are taxable at the 23% rate even though they may be invoiced after 1 September 2020.

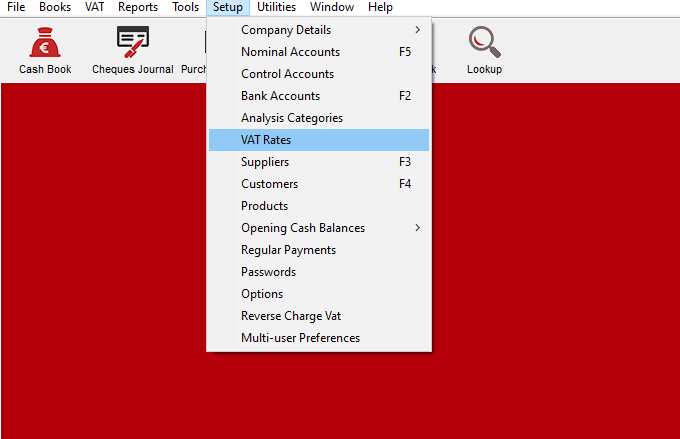

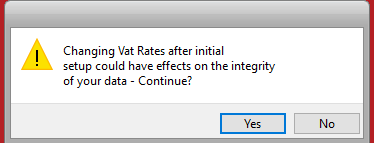

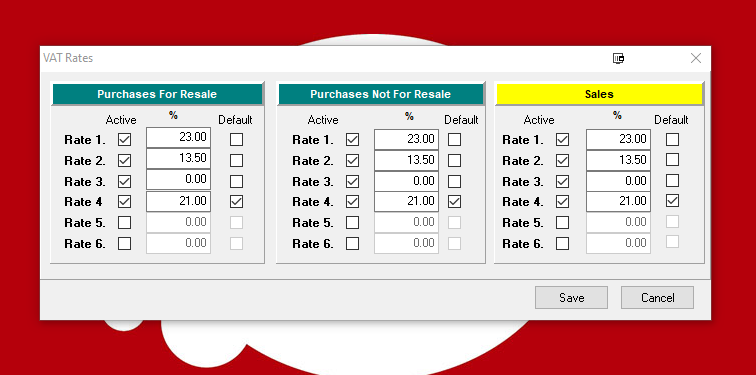

To implement these changes in Big Red Book – Firstly add a VAT Rate of 21%